To print this article, all you need is to be registered or login on Mondaq.com.

Summary

- The Full Federal Court has dismissed an appeal by Singapore

Telecom Australia Investments Pty Ltd (STAI) against transfer

pricing assessments issued by the Australian Taxation Office (ATO)

in relation to interest deductions claimed on related party

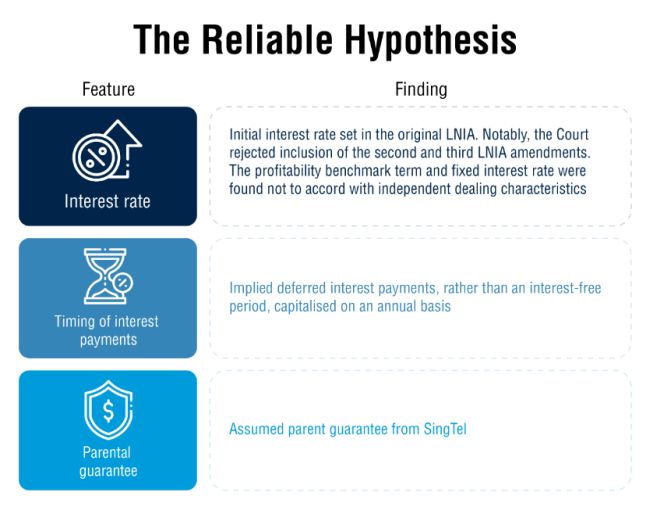

debt. - By reconstructing the reliable hypothetical transaction to be

on independent vendor financing terms, including an implied SingTel

parent guarantee, the Court concluded STAI received transfer

pricing benefits in the income years under review. - The decision provides useful guidance for the application of

Subdivision 815-A of the Income Tax Assessment Act 1997

(Cth) (ITAA 1997) and Division 13 of the Income Tax

Assessment Act 1936 (Cth) in complex related party

arrangements, which although now no longer applicable, should

remain relevant in construing Subdivision 815-B of the ITAA 1997.

It highlights the importance of considering both commercial

substance and the timing effects of a transaction. - With transfer pricing adjustments expected to trend upward

globally, the implications of this case will be keenly followed.

Revenue office activity continues to impact the ability of global

groups to claim related party deductions.

Introduction

Singapore Telecom Australia Investments Pty Ltd v

Commissioner of Taxation [2024] FCAFC 29, concerned the

ATO’s review of interest deductions claimed by STAI, a

subsidiary of Singapore Telecommunications Limited (Singtel), for

income years ending 2011 to 2013. STAI had acquired the shares in

SingTel Optus Pty Ltd in 2002 through related party vendor

financing amounting to $5.2 billion from another Singtel

subsidiary, Singtel Australia Investments Limited (SAI), documented

via a complex 10-year Loan Note Issuance Agreement (LNIA).

Under the LNIA, STAI was able to defer payment of accrued

interest until the Optus business became profitable and a

“variation notice” was issued by the lender, SAI.

However, the liability to pay the interest still accrued. The

interest rate payable under the LNIA was initially set to be

adjusted each year by reference to the one year bank bill swap rate

from time to time plus one percent. Over time, the LNIA was amended

on three occasions in ways that affected the timing and calculation

of interest. Relevantly:

- The second amendment forgave any accrued obligation to pay

interest and retrospectively ensured that there could be no

liability for interest (and therefore no withholding tax) until a

profitability benchmark was met. It then added a further interest

premium of 4.552 percent to equate to the overall interest expected

to be paid over the term for the LNIA if the amendment had not been

made. - The third amendment introduced a fixed rate of 13.5275 percent

for the balance of the term of the LNIA.In a judgment confirming the ATO’s approach, the Full Federal

Court found STAI had failed to discharge its onus to prove that the

assessments were excessive. Led by Justice Wigney, the Court

considered issues around:

- Formulating the appropriate reliable hypothetical scenario for

transfer pricing analysis - The amendments of the LNIA diverging from expected independent

dealing characteristics - STAI’s expert evidence assessing the “effective credit

spread”

Issues

Timing of Assessing Non-Arm’s Length

Conditions

The Court rejected arguments of the taxpayer suggesting that the

timing effects of the LNIA should be disregarded. In this regard,

STAI sought to demonstrate that the total interest in fact paid by

STAI over the entire 10-year term was less than the interest that

might have been expected to be paid if an arm’s length rate had

been agreed upon at the start of the arrangement, and that the

assessment of whether there was a non-arm’s length dealing

could be made at the end of the arrangement with the benefit of

hindsight.

In this regard, the Court considered that the statutory context

required the Court to consider whether a transfer pricing benefit

arose in a particular income year, rather than over the life of an

arrangement.

Reliable hypothesis

To apply the relevant tax provisions, the Court had to determine

an appropriate basis for comparison to the actual arrangements.

Subdivision 815-A and Division 13 require identifying a

hypothetical scenario reflecting independent commercial dealing in

similar circumstances. This is called the “reliable

hypothesis.”

The Court examined factors like the nature of the transaction,

characteristics of the parties and evidence from experts.

The Court did not find any errors with the primary judge’s

characterisation of the reliable hypothesis. In this regard, the

Court agreed with the primary judge that the taxpayer’s expert

evidence regarding interest rates based on a U.S. bond issue in the

debt capital market should be rejected, as this departed too far

from the actual transaction and the characteristics of the parties.

The taxpayer also failed to produce any probative evidence that

suggested that parties dealing at arm’s length would have

entered into the LNIA amendments, or enter into a vendor financing

arrangement, without a parent guarantee. The Court also found that

there was no evidence to suggest that an arm’s length fee would

be payable for such a parent guarantee provided in a vendor

financing situation.

Implications of Singapore Telecom Australia

Investments Pty Ltd v Commissioner of Taxation [2024] FCAFC

29

This case provides further guidance (following Chevron

Australia Holdings Pty Ltd v Commissioner of Taxation [2017] FCAFC

62 and Commissioner of Taxation v Glencore Investment Pty Ltd

[2020] FCAFC 187) on reconstructing a suitable hypothetical

for the transfer pricing of related party transactions and the

extent to which the actual terms of the transaction and

characteristics of the parties are relevant in this exercise.

Of particular relevance in this case was the fact that the

commercial substance of the funding was a vendor financing

arrangement, which then impacted the relevance of the

taxpayer’s expert evidence, which largely relied on comparables

in the debt capital market.

The case highlights that taxpayers carry the legal burden of

proof and must prepare evidence based on the appropriate

hypothetical transaction, rather than rely on theoretical

arguments. Further, care should be taken when relying on expert

evidence to formulate the reliable hypothesis as this is a legal

concept.

Overall, the decision confirms tax authorities’ ability to

challenge related party arrangements and the high threshold for

taxpayers to prove that their international related party dealings

do not diverge from independent market conditions between third

parties.

Originally published by 11 April, 2024

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Tax from Singapore

#Transfer #Pricing #Adjustments #Upheld #Optus #Parent #Company #Tax #Authorities