A nonprofit Statement of Activities (SOA) is a report used by nonprofit organizations to highlight their financial performance over a specific period, typically a fiscal year.

In some cases, the Statement of Activities may also be referred to as the “income statement” or “statement of revenues and expenses,” though “Statement of Activities” is the most common term among nonprofits.

The SOA details the revenue earned and expenses incurred during that period, as well as the resulting net position. For nonprofits, this net position is known as “net assets,” in contrast to the “net income” or “net profit” used by for-profit entities. While functionally similar, the terminology reflects the unique goals and nature of nonprofit organizations.

What’s included in a Statement of Activities?

While the complexity and detail of a Statement of Activities (SOA) can vary, every report will always include three key elements: Revenue, Expenses, and Net Assets. Let’s take a closer look at each of these components and some examples of what you can expect to find in each.

Revenue

Revenues represent the total income a nonprofit organization receives from various sources, such as donations, grants, program fees, and investment returns, during a specific period.

Examples of Revenue line-items within a nonprofit Statement of Activities:

- Donations and/or Contributions: These include money, goods, or services received from donors. Monetary donations can be categorized as either restricted (earmarked for a specific cause or use) or unrestricted (available for general use at the discretion of the nonprofit). Nonprofits may differentiate between restricted and unrestricted funds in the Statement of Activities depending on the intent of the report. Additionally, donations may come in the form of professional services or goods, which should also be accounted for.

- Grants Received: Funds provided by government agencies, corporate sponsors, or other foundations. Nonprofits may choose to specify the source (e.g., federal, state, or local government) and whether the grants are restricted or unrestricted, similar to donations.

- Investment Revenue: Income earned from investments, which may include profits from the sale of securities, interest, or dividends.

- Program Service Revenue: Revenue generated from services directly related to the nonprofit’s mission. This could include income from providing services, membership fees or dues, or sponsorships.

- Sales: If the nonprofit sells goods, the revenue from these sales would be recorded here, similar to program service revenue.

- Special Events: If separating revenue from specific events is useful, the organization may include a line item for “Special Events.” This section might further break down into subcategories, such as revenue from gifts, donations, auctions, etc.

Expenses

Expenses are the costs incurred by a nonprofit in carrying out its activities, including program delivery, administrative operations, and fundraising efforts.

Examples of Expenses line-items within a nonprofit Statement of Activities:

- Salaries and Compensation: This includes the costs associated with paying staff and other workers, as well as related expenses such as benefits and taxes (e.g., 401(k) contributions, payroll taxes, paid time off, workers’ compensation, etc.).

- Contract Services: Expenses related to payments for services provided by contractors who are not on the regular payroll. This can include one-time costs for services like building repairs or recurring costs for professional services such as accounting, IT, legal, marketing, etc.

- Facility and Real Estate Expenses: Costs associated with the upkeep and operation of facilities or real estate owned or leased by the nonprofit. This may include rent, utilities, repairs, and maintenance.

- Physical, Materials, Supplies, and other Operating Expenses: Funds used to purchase raw materials necessary for the nonprofit’s mission. This could include office supplies, equipment, software subscriptions, and other operational costs such as telephone or internet bills.

- Travel Expenses: Costs incurred for travel related to the nonprofit’s mission. This may include expenses for hotels, airfare, vehicle rentals, meals, and other travel-related costs.

Net Assets

Net Assets, or the “change in net assets,” represents the difference between total revenues and total expenses for a given period. This figure indicates whether the organization has gained or lost resources during that time, directly impacting its overall financial position.

To calculate Net Assets, you start by summing all sources of revenue, including donations, grants, investment income, service revenue, sales, special event income, and any other revenue streams. This gives you the total revenue line.

Next, you add together all expense items, such as salaries, facility costs, supplies, and other operational costs, to get the total expenses line.

For example, if total revenues for the fiscal year are $2,200,000 and total expenses are $1,850,000, you subtract the expenses from the revenue to determine the net assets.

In this case, the net assets for the year would be $350,000. This $350,000 can then be used to further the organization’s mission through planning activities for the upcoming years.

Statement of Activities Example

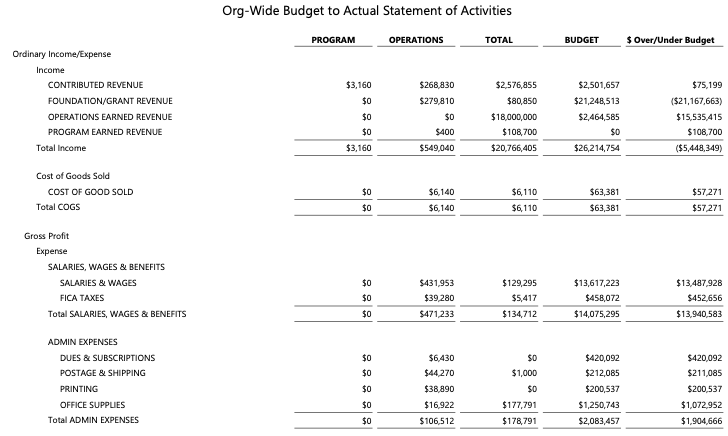

Let’s look at a real example to put everything together. Below is a sample Statement of Activities for a nonprofit organization using Blackbaud’s Financial Edge NXT software (FENXT):

How do SOAs Help Organizations?

An SOA helps nonprofits analyze their financial health by showing how revenues are generated and how funds are allocated. By comparing revenues to expenses, organizations can assess operational efficiency, ensure they’re “living within their means”, and make informed decisions about resource allocation, future programs, and fundraising strategies.

- Analysis and Accountability: The SOA is essential for demonstrating transparency to stakeholders, including donors, grantors, board members, and the public. Accurate financial reporting reassures these stakeholders that their contributions are being used responsibly and in alignment with the organization’s goals.

- Compliance: The SOA is often required for nonprofit financial reporting, especially for those tax-exempt under Section 501(c)(3) of the U.S. Internal Revenue Code. Nonprofits must submit financial statements, including the SOA, as part of their annual Form 990 filing with the IRS. These filings ensure regulatory compliance and help maintain tax-exempt status. Additionally, many grant applications and reports require audited financial statements, including the SOA.

- Format and Variability: While the SOAs content and format may vary depending on the organization’s size, mission, and funding sources, its fundamental purpose remains the same: to provide a transparent and accurate record of financial activities. Larger nonprofits may have more detailed statements, while smaller ones might have simpler versions, but the SOAs role in transparency is consistent.

To put simply, the Statement of Activities is a cornerstone of financial transparency, helping nonprofits build and maintain trust with supporters and regulators.

How are SOAs Different from an Income Statement?

So, what is the difference between a “Statement of Activities” used by nonprofits and an “Income Statement” used by a for-profit company?

The short answer: they are functionally the same. However, the language used in both the title and within the report differs, influencing how they are perceived and used.

For nonprofit entities, this summary document is a tool to assess their financial standing and make informed decisions on how to further their mission in the coming months or years. While a for-profit company may also use this information to make critical decisions about the future, their focus is more geared toward generating income rather than advancing a mission.

For example, many nonprofits use terms like “revenue” and “net assets” instead of the for-profit equivalents “income” and “net income.”

SOAs are One of Four Main Nonprofit Financial Statements

A Statement of Activities becomes even more valuable when analyzed alongside three other key nonprofit financial documents: the Statement of Financial Position, the Statement of Functional Expenses, and the Statement of Cash Flows.

Together, these documents provide a comprehensive view of the organization’s financial health from different perspectives, equipping nonprofit leaders with the insights needed to take action and bring their mission to life.

| Financial Statement | Purpose |

| Statement of Financial Position | A snapshot of a nonprofit’s assets, liabilities, and net assets at a given point in time, showing its overall financial health. |

| Statement of Activities | A report detailing a nonprofit’s revenues and expenses over a period, reflecting the changes in its net assets. |

| Statement of Cash Flows | A financial report that tracks the cash inflows and outflows of an organization, illustrating how cash is generated and used during a period. |

| Statement of Functional Expenses | A financial statement that categorizes a nonprofit’s expenses by both their function and natural classification, providing insight into how resources are allocated toward various activities. |

To learn even more about nonprofit financial reporting basics, as well as other fund accounting tips, check out our Accounting Fundamentals Revisited webinar series.

Summary FAQs

What are Common Statement of Activities Mistakes?

While mistakes can be made on any financial document, common mistakes on an SOA include:

- Misclassifying Revenues and Expenses: A common mistake is incorrectly categorizing revenues or expenses, such as recording a restricted grant as unrestricted or misallocating administrative costs to program expenses. Accurate classification is crucial for reflecting the true financial health of the organization.

- Failing to Separate Restricted and Unrestricted Funds: Nonprofits sometimes neglect to distinguish between restricted and unrestricted funds in their SOA, leading to confusion and misrepresentation of the organization’s financial position. Properly differentiating these funds ensures that financial statements accurately reflect donor intentions and fund usage.

- Omitting In-Kind Contributions: Failing to include in-kind donations, such as donated goods or services, can lead to an incomplete financial picture. In-kind contributions should be recorded at their fair market value to accurately reflect the organization’s total resources and expenses.

- Inconsistent Reporting Periods: Another common error is inconsistently reporting financial data, such as mixing up fiscal years or not aligning the reporting period with other financial statements. Consistent and accurate reporting periods are essential for clear and comparable financial analysis.

To learn more about potential pitfalls and how to avoid them, check out our article on the most common SOA mistakes!

What is the Most Common Reporting Period for a Statement of Activities?

While the fiscal year is the most common choice for a Statement of Activities (SOA), it’s not the only option. The fiscal year usually makes sense because it lines up with other key financial documents, making it easier for managers and stakeholders to analyze and compare the numbers.

That said, nonprofits can choose other reporting periods, like the calendar year, depending on their needs or any specific regulations they have to follow. The main thing is to stick with the same reporting period consistently, so the financial analysis stays accurate and easy to compare over time.

Why Should you Distinguish Between Restricted and Unrestricted Revenue in the Statement of Activities?

Distinguishing between restricted and unrestricted revenue is important because it reflects the donor’s intentions and how funds can be used:

- Restricted Revenue: These funds come with specific conditions set by the donor, meaning they must be used for designated purposes or projects.

- Unrestricted Revenue: These funds are available for general use and can be applied to any area of need within the organization.

This distinction helps organizations track and report how they are meeting donor expectations, ensuring transparency in how funds are allocated and spent. By clearly separating these categories in the Statement of Activities, nonprofits can demonstrate their commitment to honoring donor intent and maintaining financial integrity.

#Statement #Activities #SOA #Nonprofit #Glossary #Guide