On March 6, 2024, the U.S. Securities and Exchange Commission

(SEC) adopted the long-anticipated Climate-Related Disclosure Rules aimed at

enhancing transparency and disclosure around climate-related risks

and opportunities for U.S. public companies and most foreign

private issuers. The SEC received more than 24,000 comments

following publication of the proposed rules in March 2022.

While the final rules are meaningfully scaled back from the

proposed rules, notably eliminating the proposed requirement to

disclose Scope 3 greenhouse gas emissions, the final rules are

still some of the most sweeping and controversial ever passed by

the SEC. The SEC adopted delayed and staggered compliance dates for

the final rules that vary according to the filing status of the

registrant. Immediately upon adoption, the final rules were met

with lawsuits that challenge their validity and enforceability.

While states and businesses claim the new rules go too far,

environmental groups say the rules do not go far enough.

Notwithstanding the numerous legal challenges to the

Climate-Related Disclosure Rules that could delay or prevent

implementation that are described below, companies should consider

taking these recommended actions now:

1. Educate Management and the Board

- Consider a presentation to management and the company’s

board on the new rules. Do not assume that directors are aware of

these rules or their significance to the organization.

2. Assess Climate-Related Disclosure

Readiness

- Public companies that have not started to do so already should

assess what climate information they have and how it is collected,

tracked, measured, and monitored. - Does the company have the right third-party experts to assist

from an auditing and compliance standpoint? In addition to in-house

teams, these specialists can help ensure that companies have the

appropriate processes in place needed to identify, analyze and

disclose all information required by the Climate-Related Disclosure

Rules. The costs associated with complying with these rules is

anticipated to be significant. We expect that, since many companies

will be in the market for the same greenhouse gas (GHG) emissions

attestation service providers at the same time, costs may end up

being more expensive than for current attestation services. - Public companies should be aware that the Climate-Related

Disclosure Rules will affect their filings with the SEC

meaningfully. Companies should begin to assess where and how

climate-related disclosures will be presented in annual reports

(Form 10-K or 20-F) or in registration statements. Other than the

financial statement footnote, the narrative and quantitative

disclosures will be tailored for each company. For example, the

disclosure may be best accumulated in a new, standalone section

identified by the adopting release under the caption

“Climate-Related Disclosures”, or a company may prefer to

weave in disclosure across existing sections, such as Business,

Risk Factors, and MD&A. - The Climate-Related Disclosure Rules are expected to require

significant changes in internal control over financial reporting

and disclosure controls and procedures. These changes should be

considered now, as public company CEOs and CFOs will be required to

certify to the disclosures beginning with the report for the first

fiscal quarter of 2025. - From a governance standpoint, companies should take stock of

experience and oversight. Does management have the right mix of

experience to assess and manage risk? Which committee has

oversight, and are those duties accurately delegated in committee

charters? Does the company have an adequate policy for reporting

climate-related risks to management, the board or a board

committee? - With respect to a company’s overall ESG approach, companies

should review existing statements, goals and targets (whether in

SEC reports, CSR reports, on corporate websites, or otherwise), or

consider whether to adopt any such goals or targets.

3. Consider the Interplay of the Climate-Related

Disclosure Rules With Other Applicable Climate Disclosure

Rules

- Public companies should evaluate whether they are required to

report climate or related information under other laws, including

the three 2023 California climate disclosure laws (Senate Bills 253

and 261 and Assembly Bill 1305) and the EU’s Corporate

Sustainability Reporting Directive (CSRD).

4. Continue to Monitor Developments and Other Regulatory

and Government Efforts

- While companies do not have the luxury to adopt a wait-and-see

approach to see how the lawsuits are resolved, they should

nonetheless be mindful of the challenges from both sides. We will

keep you abreast of significant developments in this area.

Enhanced Disclosure Requirements

One of the central pillars of the Climate-Related Disclosure

Rules is the requirement for companies to provide comprehensive

disclosure regarding their climate-related risks and opportunities.

This includes detailing the effect of climate change on their

business operations, financial performance, and strategies for

mitigating associated risks. Some key disclosure items are:

- New Subpart 1500 – Climate-Related Disclosure in

Regulation S-K

- Greenhouse Gas Emissions:

- Scope 1 and 2 emissions will be required, “if such

emissions are material,” for registrants that qualify as a

large accelerated filer (LAF) or an accelerated filer (AF). Smaller

reporting companies and emerging growth companies are exempt from

this disclosure requirement. - Compared to the proposal, the final rules modified the proposed

assurance requirement covering Scope 1 and Scope 2 emissions for

AFs and LAFs by extending the reasonable assurance phase in period

for LAFs and requiring only limited assurance for AFs. - Meaningfully, the SEC eliminated the proposed requirement to

provide Scope 3 emissions disclosure, which the proposal would have

required in certain circumstances. Scope 3 emissions are indirect

greenhouse gas (GHG) emissions by the various components of a

company’s supply chain. The EPA describes Scope 3 emissions as

follows: “Scope 3 emissions are the result of activities from

assets not owned or controlled by the reporting organization, but

that the organization indirectly affects in its value chain. Scope

3 emissions include all sources not within an organization’s

scope 1 and 2 boundary. The scope 3 emissions for one organization

are the scope 1 and 2 emissions of another organization. Scope 3

emissions, also referred to as value chain emissions, often

represent the majority of an organization’s total greenhouse

gas (GHG) emissions.”

- Scope 1 and 2 emissions will be required, “if such

- Governance:

- The SEC eliminated the proposed requirement to describe board

members’ climate expertise. - New Item 1501(a) of Reg. S-K states, “If there is a

climate-related target or goal disclosed pursuant to [Item 1504 of

Reg. S-K] or transition plan disclosed pursuant to [Item 1502(e)(1)

of Reg. S-K], describe whether and how the board of directors

oversees progress against the target or goal or transition

plan.” - New Item 1501(b) of Reg. S-K states, “Describe

management’s role in assessing and managing the

registrant’s material climate-related risks.”…

- In providing such disclosure, provide …. “the relevant

expertise of such [management positions or committees responsible

for assessing and managing climate-related risks] in such detail as

necessary to fully describe the nature of the expertise”

- In providing such disclosure, provide …. “the relevant

- New Item 1504(a) of Reg. S-K states, “A registrant must

disclose any climate-related target or goal if such target or goal

has materially affected or is reasonably likely to materially

affect the registrant’s business, results of operations, or

financial condition.”

- The SEC eliminated the proposed requirement to describe board

- Greenhouse Gas Emissions:

- New Subpart 14 of Regulation S-X

- In a new footnote to the audited financial

statements:

- “[If meeting the disclosure threshold described below],

disclose the aggregate amount of expenditures

expensed as incurred and losses, excluding recoveries,

incurred during the fiscal year as a result of severe

weather events and other natural conditions, such as hurricanes,

tornadoes, flooding, drought, wildfires, extreme temperatures, and

sea level rise. For example, a registrant may be required

to disclose the amount of expense or loss, as applicable, to

restore operations, relocate assets or operations affected by the

event or other natural condition, retire affected assets, repair

affected assets, recognize impairment loss on affected assets, or

otherwise respond to the effect that severe weather events and

other natural conditions had on business operations.”

(emphasis added) - Disclosure will be required only when and if the aggregate

amount of expenditures expensed as incurred and losses equals or

exceeds one percent of the absolute value of income or loss

before income tax expense or benefit for the relevant

fiscal year (i.e., not required if less than $100,000). (emphasis

added) - Also, “[d]isclose whether the estimates and assumptions

the registrant used to produce the consolidated financial

statements were materially impacted by exposures to risks and

uncertainties associated with, or known impacts from, severe

weather events and other natural conditions, such as hurricanes,

tornadoes, flooding, drought, wildfires, extreme temperatures, and

sea level rise, or any climate-related targets or transition plans

disclosed by the registrant. If yes, provide a qualitative

description of how the development of such estimates and

assumptions were impacted by such events, conditions, targets, or

transition plans.”

- “[If meeting the disclosure threshold described below],

- In a new footnote to the audited financial

Materiality Assessment

The Climate-Related Disclosure Rules emphasize the importance of

materiality in climate-related disclosures and, in a departure from

the proposed rules, the final rules are generally less prescriptive

and include additional materiality qualifiers for certain climate

risk disclosures. With respect to GHG disclosures, even if the

registrant is confident its GHG emissions are not material, it

appears that the SEC expects them to be tracked in order to make

such a determination, and such tracking will need to be covered by

disclosure controls and procedures maintained in accordance with

the Sarbanes-Oxley Act of 2002.

Integration into Reporting Frameworks

The adopting release acknowledges that, where consistent with

the SEC’s objectives and the authority Congress granted,

certain provisions in the new rules are similar to existing

reporting frameworks, such as the Task Force on Climate-related

Financial Disclosures (TCFD) recommendations and the World Business

Council for Sustainable Development and World Resources Institute

Greenhouse Gas Protocol (GHG Protocol). The adopting release states

that “[t]he TCFD framework focuses on matters that are

material to an investment or voting decision and is grounded in

concepts that tie climate-related risk disclosure considerations to

matters that may affect the results of operations, financial

condition, or business strategy of a registrant.” Accordingly,

to streamline reporting and ensure consistency, the SEC encourages

companies to align their climate disclosures with these existing

frameworks.

The SEC also anticipates that because many companies already

adhere to TCFD standards, leveraging those “reporting

frameworks will mitigate those registrants’ compliance burdens

and help limit costs.” This alignment should facilitate

comparability and allow investors to better evaluate companies’

climate-related performance.

The adopting release also summarizes competing reporting

regimes, including ISSB standards (which some foreign jurisdictions

have adopted or plan to adopt); the European Union’s Corporate

Sustainability Reporting Directive; California’s

Climate-Related Financial Risk Act, which requires all U.S.

companies that do business in California with over $500 million in

annual revenues to make certain climate-related disclosures; and

California’s Climate Corporate Data Accountability Act, which

requires U.S. companies that do business in California with over $1

billion in annual revenues to disclose GHG emissions.

The SEC notes that the other laws and regulations may overlap

with its climate change rules, could reduce compliance and cost

burdens, and require separate disclosure outside of the SEC’s

public disclosure regime.

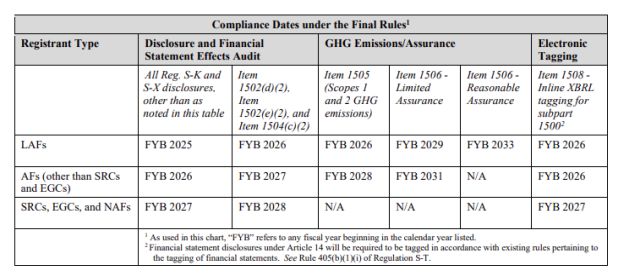

Compliance Timeline

This table on compliance dates was included in the adopting

release:

For example, an LAF with a Dec. 31 fiscal year end will not be

required to comply with the climate disclosure rules (other than

those pertaining to GHG emissions and those related to Reg. S-K

Item 1502(d)(2), Item 1502(e)(2), and Item 1504(c)(2), if

applicable) until its Form 10-K for fiscal year ended December 31,

2025, due in March 2026. If required to disclose its Scopes 1

and/or 2 emissions, such a filer will not be required to disclose

those emissions until its Form 10-K for fiscal year ended Dec. 31,

2026, due in March 2027, or in a registration statement that is

required to include financial information for fiscal year 2026.

Such emissions disclosures would not be subject to the requirement

to obtain limited assurance until its Form 10-K for fiscal year

ended Dec. 31, 2029, due in March 2030, or in a registration

statement that is required to include financial information for

fiscal year 2029.

The registrant would be required to obtain reasonable assurance

over such emissions disclosure beginning with its Form 10-K for

fiscal year ended Dec. 31, 2033, due in March 2034, or in a

registration statement that is required to include financial

information for fiscal year 2033. If required to make disclosures

pursuant to Reg. S-K Item 1502(d)(2), Item 1502(e)(2), or Item

1504(c)(2), such a filer will not be required to make such

disclosures until its Form 10-K for fiscal year ended Dec. 31,

2026, due in March 2027, or in a registration statement that is

required to include financial information for fiscal year 2026.

As an accommodation, the final rules provide that any GHG

emissions metrics required to be disclosed pursuant to Item 1505 in

an Annual Report on Form 10-K may be incorporated by reference from

the registrant’s Form 10-Q for the second fiscal quarter in the

fiscal year immediately following the year to which the GHG

emissions disclosure relates, or may be included in an amended

annual report on Form 10-K no later than the due date for such Form

10-Q. The extension of the deadline for the filing of GHG emissions

metrics also applies to the deadline for the filing of an

attestation report, which should accompany the GHG emissions

disclosure to which the report applies.

The SEC stated in its adopting release that this additional time

– an additional two fiscal quarters – should provide

registrants subject to Item 1505 and their GHG emissions

attestation providers with sufficient time to measure GHG

emissions, provide assurance, and prepare the required attestation

report. The final rules provide that a registrant that elects to

incorporate by reference its attestation report from its Form 10-Q

for the second fiscal quarter or to provide its attestation report

in an amended annual report must include an express statement in

its Annual Report on Form 10-K indicating its intention to either

incorporate by reference the attestation report from a quarterly

report on Form 10-Q or amend its annual report to provide the

attestation report by the due date specified in Item 1505.

Legal Challenges

Immediately after the SEC released the new rules, 10 states

(Alabama, Alaska, Georgia, Indiana, New Hampshire, Oklahoma, South

Carolina, Virginia, West Virginia and Wyoming) brought an action in

the U.S. Court of Appeals for the Eleventh Circuit arguing that the

SEC’s Climate Rules exceed the agency’s authority and are

arbitrary, capricious, an abuse of discretion, and not in

accordance with law. The states asked the court to declare the new

rules unlawful and vacate the SEC’s Climate Rules.

Since then, eight more cases have been filed in the Second,

Fifth, Sixth, Eighth, Eleventh and District of Columbia circuits by

Republican attorneys General, oil and gas industry groups, and

environmental advocacy organizations. While petitioners generally

chose to file in circuits that they perceived as sharing their

political perspective, following a request by the SEC on March 19,

the Judicial Panel on Multidistrict Litigation conducted a lottery

and the Eighth Circuit was selected to hear all of the consolidated

cases.

On March 15, on motion of petitioners Liberty Energy Inc. and

Nomad Proppant Services LLC, the Fifth Circuit granted an

administrative stay of the rules pending review. It is anticipated

that this stay will remain in effect at least until the cases are

consolidated in a single circuit. If a court other than the Fifth

Circuit is chosen, that court can determine whether to maintain or

dissolve the stay.

Based on public comments and statements since the final climate

rule was approved by the SEC, the bases for some substantive

challenges by attorneys general and business interests are likely

to include the Administrative Procedures Act (the APA) (i.e., the

rule is arbitrary and capricious, and contrary to law); the rule

exceeds the SEC’s statutory rulemaking authority: the Major

Questions Doctrine (climate disclosures are matters of “vast

economic and political significance” and there is no clear

Congressional authorization to regulate them); and the First

Amendment (i.e., the required disclosures are unconstitutional

speech).

Similar arguments doomed the SEC’s issuer share repurchase

rules, which were vacated at the end of 2023. Depending on the

decisions the Supreme Court makes later this term on pending cases

challenging the Chevron deference, these petitioners may also be in

a position to assert that no deference is due to the SEC decision,

and that the reviewing court has the power to weigh the evidence in

the record on its own.

At the other end of the spectrum, the Natural Resources Defense

Council and the Sierra Club, which filed petitions in the Second

Circuit and D.C. Circuit, respectively, are planning to argue that

the climate rule does not go far enough, Both are expected to argue

that the SEC’s decision to drop Scope 3 disclosures from the

final rule and soften Scope 1 and 2 disclosure requirements does

not satisfy the SEC’s obligations to protect investors and

provide them with the information they need to manage

climate-related financial risks.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

#Key #Takeaways #SECs #ClimateRelated #Disclosure #Rules #Climate #Change