Michael Bacina, Steven Pettigrove, Tim Masters, Jake Huang,

Luke Higgins, Luke Misthos & Kelly Kim of the Piper Alderman

Blockchain Group bring you the latest legal, regulatory and project

updates in Blockchain and Digital Law.

SBF Sentenced in FTX Failure Fraud Fallout

Today Sam Bankman-Fried (commonly known as

SBF), former CEO and founder of the collapsed

cryptocurrency exchange FTX, was sentenced to 25 years in prison in

the US following his conviction last year on 7 counts of fraud and

conspiracy.

Judge Kaplan said during sentencing the:

He knew it was wrong. He knew it was criminal.

SBF gave an apology saying:

A lot of people feel really let down, and they were very let

down … I’m sorry about that. I’m sorry about what

happened at every stage

The 31-year-old former billionaire was convicted last year on

two counts of fraud and five counts of conspiracy related to the

failure of FTX in November 2022, after an USD$8 billion hole was

uncovered in its balance sheet. With his lieutenants, Caroline

Ellison, Gary Want, and Nishad Singh, who were all his friends (and

in Ms Ellison’s case a sometimes romantic partner) testifying

against him, and the evidence drawing damning instances of

falsehoods presented to customers, the outcome of his conviction

was not at all unexpected.

The sentence of 25 years in prison is at the lower end of

betting platform Polymarket which showed popular opinion of

convicted 20 to 40 years.

This sentence arrives about 17 months after FTX

filed for bankruptcy, leading to a rapid corporate collapse

that shocked financial markets and erased Bankman-Fried’s

estimated USD$26 billion personal fortune.

The collapse and subsequent fraud case has been swift:

Before the sentencing verdict was delivered, a presentence

probation officer complied a report recommending a 100-year

sentence. The Department of Justice urged a 40 to 50 year sentence, and SBF’s lawyers suggested 63 to 78 months. SBF’s legal

team argued there was a lack of actual losses by the victims based

on FTX’s bankruptcy estate estimation that creditors will

likely be made whole and repaid as much as 120-140 per cent of what

their assets were worth on the day of FTX’s bankruptcy.

John Ray strongly criticised the argument by SBF’s legal

team last week, saying that despite the exchange returning

“substantial value to creditors” SBF:

continues to live a life of delusion.

Michael Lewis’ book about FTX, Going Infinite, however criticised Mr

Ray’s actions after being appointed, which he claimed increased

fees dramatically.

A dozen of creditors submitted

letters saying they suffered hardships because they

couldn’t access their funds for the last year and a half.

Once considered a prominent figure in the crypto world,

SBF’s fall from grace now places him among the ranks of

individuals convicted of major U.S. financial crimes, including Bernie

Madoff, Jordan Belfort, and Ivan Boesky. An appeal over the

verdict and the sentencing is planned.

Singapore rolls out new crypto rules

Singapore has finalised amendments to the Payment Services Act

(PSA) and its subsidiary legislation this week,

expanding the scope of regulated activities and introducing more

stringent obligations on digital payment token

(DPT) service providers.

The changes take effect in stages from today, 4 April

2024, and will bring the following activities within the scope

of the PSA:

- (i) Provision of custodial services for DPTs;

- (ii) Facilitation of the transmission of DPTs between accounts

and facilitation of the exchange of DPTs, even where the service

provider does not come into possession of the moneys or DPTs;

and - (iii) Facilitation of cross-border money transfer between

different countries, even where moneys are not accepted or received

in Singapore.

Further, under the amended Act, the Monetary Authority of

Singapore (MAS) is empowered to impose

obligations concerning anti-money laundering and counter terrorism

financing (AML/CTF), user protection and financial stability on DPT

service providers. The provisions on safeguarding consumer

assets are expected to take effect six months after 4 April

2024.

DPT service providers and crypto firms providing any of the

regulated activities are required under transitional arrangements

to:

- (i) notify the MAS within 30 days;

- (ii) submit a licence application within 6 months from 4 April

2024; and - (iii) submit an attestation report of the entity’s business

activities and AML/CTF compliance, within 9 months from 4 April

2024

The regulator warned:

Entities that do not fulfil the requirements above are required

to cease the activities

In addition, the MAS recently published guidelines on consumer

protection requirements for firms engaged in DPT services, with

a view to promoting ‘sound and robust practices’ for DPT

service providers. The guidelines will take effect on 4 October

2024 and address items including segregation of customer assets,

risk management controls, disclosure requirements to customers

among other consumer protection measures.

Angela Ang, a former MAS regulator and policy

advisor at TRM Labs, stated:

This expansion has been in the works since 2021 and brings much

anticipated regulatory clarity to crypto custody players in

Singapore.

The latest changes to the Payment Services Act are the culmination of several years of work to expand

the scope of Singapore’s regulatory regime with respect to

crypto related services, and incorporate greater consumer

protections in relation to custody and marketing of those services.

The legislation itself will no doubt be the subject of careful

scrutiny as providers who offer services in Singapore will need to

carefully assess the scope of the regulation to determine if they

will require licensing in order to continue carrying on business in

the city state.

The latest changes to the PSA position Singapore alongside Hong

Kong and Japan in APAC in seeking to establish comprehensive and

fit for purpose regulatory regimes for crypto-assets.

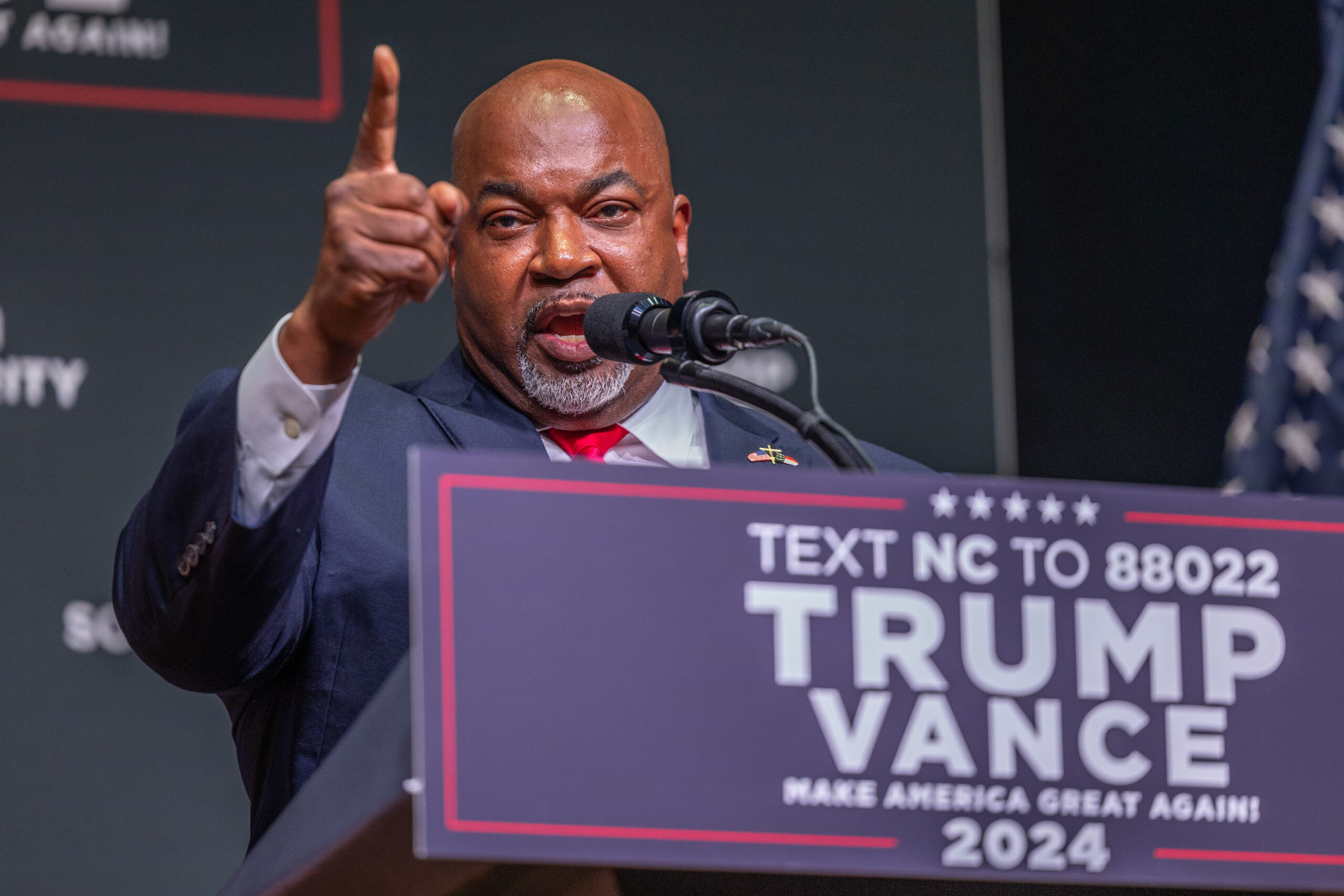

Coinbase to seek SEC discovery

In the latest development in the US Securities and Exchange

Commission (SEC) v Coinbase, a US federal

judge has allowed the SEC’s enforcement action against Coinbase (COIN.O) to move forward, but dismissed

allegations by the US regulator relating to Coinbase’s self

custodial wallet product, Coinbase Wallet.

The SEC sued Coinbase in June 2023, alleging Coinbase

breached US securities laws in

operating its crypto asset trading platform as an unregistered

national securities exchange, broker, and clearing agency.

Coinbase filed a motion to dismiss the lawsuit in August 2023,

on the basis that none of the 12 tokens cited in the SEC’s

complaint are unregistered securities. Coinbase asserted during oral arguments in January that the four

Coinbase services cited in the SEC’s complaint—general

token sales, Coinbase Prime for institutional customers, the

Coinbase Wallet, and the exchange’s staking service—were

all outside the SEC’s purview.

In determining dueling summary judgment applications, US District Judge Katherine Polk Failla sided with

Coinbase’s arguments in relation to its wallet services,

while permitting the SEC allegations in respect of the remaining

products to move forward.

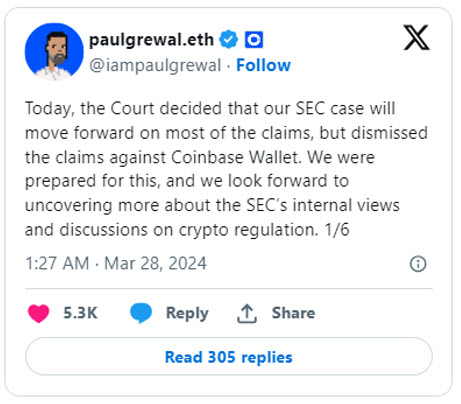

Coinbase Chief Legal Officer Paul Grewal commented on X that the

result was not unexpected, as

Early motions like ours against a government agency are almost

always denied

Coinbase intends to use the court’s discovery process to

gain insight into the SEC’s evolving regulatory approach on

crypto:

Grewal also encouraged Congress to build on momentum from last

year to advance comprehensive digital assets legislation, which he

said is critical for innovation to remain in the US.

Coinbase has long been seeking regulatory clarity from the SEC,

even before this dispute. Coinbase’s efforts include filing a petition requesting the SEC to exercise its rule making

powers to establish a clear regulatory regime for crypto-assets,

and later suing the SEC for failure to respond to the petition, which

led to the SEC being ordered by court to explain its failure to respond.

That dispute looks set to return to the Courts with Coinbase

challenging the SEC’s failure to exercise its rule making

powers in respect of cryptocurrencies as “arbitrary and

capricious”.

While the SEC appears to have scored an early victory in its

litigation against Coinbase, the proceedings remain at a

preliminary stage and, as we have seen in the Ripple litigation, there

are likely to be several more twists and turns as Coinbase battles

the SEC’s claims on its own behalf and, in many ways, on behalf

of the industry as a whole.

Bitcoin blunder: Craig Wright’s assets frozen by UK

judge

The crypto caper for Craig Wright continues as UK judge Justice

Mellor recently ordered a worldwide freeze over

Wright’s assets. The order was made following an

application by the Crypto Open Patent Alliance

(COPA), after their recent victory over Wright where Justice Mellor

ruled that Wright was not the pseudonomous creater of Bitcoin, Satoshi

Nakamoto.

Central to the Justice Mellor’s concerns was Wright’s

endeavor to transfer assets, amounting to £6 million, to

offshore entities through his RCJBR Holding company shortly after

the judgment in the high-profile case was handed down on 14 March

2024. Justice Mellor found that this manoeuvre was a potential

strategy to circumvent the financial repercussions of Wright’s

legal defeat.

Judge Mellor’s judgment highlights Wright’s past

tendencies of financial non-compliance, emphasising the gravity of

COPA’s claim for legal costs which stands at a substantial

£6.7 million. This history, coupled with the recent asset

transfer, raised red flags regarding the likelihood of dissipation,

prompting the imposition of a global freezing order. In their

submissions, COPA raised several arguments that were persuasive,

including to Wright’s “dishonesty” in light of the

overall history and narrative of the case:

At the general level, COPA submit that Dr Wright has shown

himself prepared to lie and double-down on his lies, on such a

grand scale that his “commercial morality” can only be

assessed as being unacceptably low.

COPA also referred to another of Wright’s legal losses in the 2021 Kleiman litigation where

he was ordered to pay US $142m, and noted that Wright was held

to be in contempt of court in Florida just two days after his loss

in the COPA case:

There [has been] a recent ruling against Dr Wright in the

ongoing Kleiman litigation in Florida. As recently as 15 March

2024, Dr Wright was held to be in contempt of court in Florida, by

reason of his failure to provide asset disclosure previously

ordered by the Florida court.

Justice Mellor ultimately found COPA’s arguments convincing

and ordered a worldwide indefinite freeze over Wright’s assets,

making the following orders:

First, COPA has a very powerful claim to be awarded a very

substantial sum in costs.

Second, I consider there is a very real risk of dissipation.

Third, it is just in all the circumstances to grant a freezing

order [over Wright’s assets].

In the particular circumstances, it is also plain that the order

must extend worldwide.

Many in the blockchain space are keen to see the spectacle of Dr

Wright’s lawsuits come to an end, and the decisions for

contempt and asset freezing may well be the start of the end of

this sorry story.

Binance executive sues Nigeria over illegal detention

Tigran Gambaryan, the Head of Financial Crime Compliance for

Binance and a respected former US Government official, has

commenced legal proceedings against the Nigerian government after

he was detained on a business trip to the country to meet with

local authorities. Mr Gambaryan has lodged a motion with the Federal High Court in

Abuja, alleging a violation of his fundamental human rights and

that the government’s confiscation of his passport runs counter

to Nigeria’s constitutional protections.

Binance, along with other cryptocurrency exchanges, have come under intense scrutiny in Nigeria over

allegations of currency manipulation and tax evasion. Mr Gambaryan

was detained by the Nigerian authorities on a trip to the country

to meet with the Office of the National Security Advisor

(ONSA) and the Economic Financial Crimes

Commission (EFCC). It was understood that Mr

Gambaryan’s trip and subsequent detention arose initially from

the Nigerian government’s requests for information from

Binance, rather than any alleged personal wrongdoing on his

part.

Mr Gambaryan and his colleague Nadeem Anjarwalla, Binance’s

regional manager for Africa, were first detained by Nigerian authorities in

February. It has been reported that Mr Anjarwalla managed to escape custody earlier this week, utilising

his Kenyan passport to depart the country after surrendering his

British travel document. He has reportedly followed Mr

Gambaryan’s lead in filing a similar lawsuit against the

Nigerian government for wrongful detention.

Binance announced it would discontinue all services in

Nigeria on 8 March 2024. It also released a statement in mid-March noting that it

had complied with over 600 information requests from Nigerian law

enforcement agencies. The country’s Federal Inland Revenue

Service (FIRS) has since levied tax evasion

charges against Binance and the senior executives, in an apparent

attempt to justify their ongoing detention.

Mr Gambaryan is a well-known figure in the blockchain industry,

and one of the key protagonists in Andy Greenberg’s book, Tracers in the Dark. As a senior IRS

official, Mr Gambaryan was involved in probes into Silk Road, Russian crypto exchange

BTC-e and the infamous Mt. Gox hack, among many others. Mr

Gambaryan’s detention has gained significant media and public

attention in the United States. A change.org petition has been created by his

wife, petitioning for his release from custody.

Mr Gambaryan’s detention is a stark reminder of the

uncertain and shifting legal landscape for cryptocurrency in many

countries, and the importance of ensuring the safety and security

of personnel when they travel and represent businesses. In this

case, cryptocurrency’s success in serving the needs of

Nigerians battling a volatile currency seems to have attracted

scrutiny and political risk for exchanges like Binance, with

unfortunate consequences for its own staff. The authors hope that

the efforts of the blockchain industry and others will see the

swift release of Mr Gambaryan.

You can join the change.org petition and add your voice here if

you would like to support Mr Gambaryan.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

#Blockchain #Bites #SBF #Sentenced #FTX #Fallout #Singapore #rolls #crypto #rules #Coinbase #seek #SEC #discovery #Craig #Wrights #assets #frozen #judge #Binance #executive #sues #Nigeria #Fin #Tech