To print this article, all you need is to be registered or login on Mondaq.com.

Michael Bacina, Steven Pettigrove, Tim Masters, Jake Huang,

Luke Higgins, Luke Misthos & Kelly Kim of the Piper Alderman

Blockchain Group bring you the latest legal, regulatory and project

updates in Blockchain and Digital Law.

ASIC appeals Finder decision

The Australian Securities and Investments Commission

(ASIC) has

announced that they will appeal the Federal Court’s

decision

dismissing ASIC’s allegations that Finder Wallet’s Earn

product was a debenture.

This crypto-asset Earn product allowed users to transfer cash,

purchase True AUD stablecoins and be paid a fixed return for giving

Finder the use of the stablecoins. Customers were paid in AUD on a

compounding return of either 4.01% or in some cases 6.01% with a

nifty little second by second counter showing the interest clocking

up.

ASIC had alleged that by providing the Earn product, Finder

Wallet provided unlicensed financial services, breached product

disclosure requirements and failed to comply with design and

distribution obligations.

ASIC’s allegation centred around the Earn product being a

debenture under Section 9 of the Corporations Act

2001 (Cth) (the Corporations Act)

– with which the Federal Court disagreed. A debenture is

defined as follows under the Corporations Act:

debenture of a body means a chose in action that includes an

undertaking by the body to repay as a debt money deposited with or

lent to the body. The chose in action may (but need not) include a

security interest over property of the body to secure repayment of

the money.

The Federal Court dismissed ASIC’s claims on 14 March 2024

and ordered ASIC to pay costs.

Now ASIC has appealed this decision. It said it is doing so

because

it is concerned that the Finder Earn product was offered without

the appropriate licence or authorisation and therefore without the

benefit of important consumer protections.

ASIC has pursued its case on the basis that the Finder Earn

product on the narrow basis that the product was a form of

debenture. In a

similar recent case involving Block Earner, ASIC alleged that two

yield bearing products also involving cryptocurrency related

offerings were in the form of a managed investment scheme,

financial investment or derivative. The primary judge in this case

was not required to address these matters based on ASIC’s

pleaded case.

It appears from ASIC’s

Notice of Appeal that it is basically re-running the same

arguments, claiming that the primary judge “erred in” in

applying the law, and his categorization of the Earn product

terms.

ASIC’s appeal is not a huge surprise, as the decision and

adverse costs order was a significant set back for ASIC, which has

recently

indicated its intention to test its regulatory

perimeter in relation to cryptocurrency related offerings.

It also follows a partial win in the Block Earner case, in

which

ASIC failed to establish that Block Earner’s access product was

a financial product.

The appeal will be heard by the Full Federal Court on a date to

be determined. It has been

reported that Finder is “disappointed” with

ASIC’s decision not to accept the Federal Court ruling, but is

prepared to diligently defend its product in the Full Federal

Court.

Australia scores early success in the war on

scams

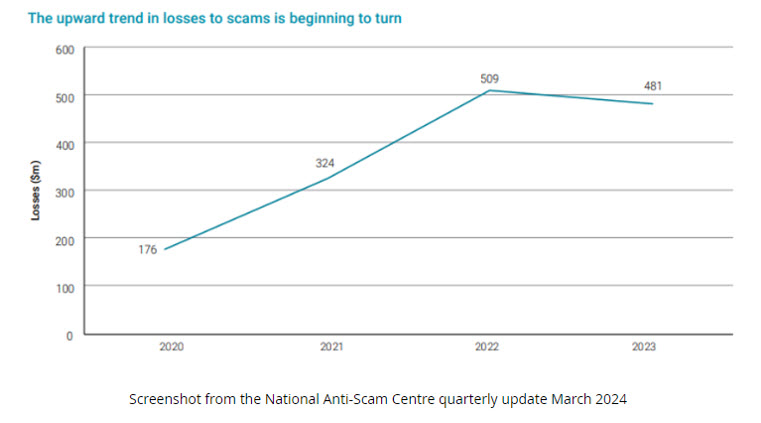

The recent quarterly update from the National Anti-Scam Centre

published 12 March 2024, revealed an optimistic decline of 43%

in the overall scam losses in the year 2023 December quarter. In

particular, losses by cryptocurrency saw the sharpest decline by

74%. This is likely to be further reduced in the coming years, with

the report detailing plans for

cryptocurrency scam data to be collected commencing in early

2024, to begin the necessary work to begin making scam data

available to the Digital Currency Exchange sector.

In the report, Catriona Lowe, the Deputy Chair of the Australian

Competition and Consumer Commission (ACCC)

reflected the National Anti-Scam Centre’s commitment to:

Advocating for mandatory and enforceable industry codes for

banks, telecommunications providers, digital platforms, and

cryptocurrency exchanges.

The Australian Banking Association (

) welcomed the new report, with the CEO Anna

Bligh stating:

It is encouraging that efforts to protect people are making a

difference

However, Bligh warned that the fight against scams requires

collective effort:

we must all continue to remain vigilant…banks, government,

telcos, social media platforms as well as consumers continue to

work together to stay one step ahead of scammers.

In particular, she noted:

Scammers often use crypto exchanges as the getaway vehicle of

choice to siphon funds. Banks are now regularly blocking or

limiting suspect transfers to high-risk crypto exchanges.

The new

Scam-Safe Accord imposes a high standard of consumer

protection on banks and will see a $100M investment in a new payee

system. This is designed to reduce scams by allowing consumers to

verify the payee prior to transferring money. Other initiatives

under this Accord include:

introducing more warnings and payment delays for consumer

protection;

adopting technology and controls to prevent identity fraud, such

as the use of at least one biometric check for new customers;

Expanding intelligence sharing across the banking sector;

and

Requiring all banks to implement an anti-scams strategy to

enhance oversight of the bank’s scams detection and response

mechanisms

While the battle against scams continues, the early signs of

success in the latest report highlight that Australia’s

anti-scam strategies are headed in the right direction. With

combined efforts from institutions, regulators and consumers, it is

optimistic that more Australians will be safeguarded from scams. As

Lowe commented:

There is much more to be done, however we are making a

difference.

D’Oh Kwon: Terraform Labs and Founder lose SEC

battle

Following a nine day trial in the Manhattan federal court, a

verdict has been handed down by the jury,

finding Terraform Labs and its co-founder, Do Kwon, liable for

security fraud by misleading investors. The director of the

SEC’s enforcement division, Gurbir S. Grewal, had the following

to say:

Terraform Labs and [Do Kwon] deceived investors about the

stability of the crypto asset security and so-called algorithmic

stablecoin TerraUSD, and they further misled investors about

whether a popular payment application used Terraform’s

blockchain to process and settle payments

The SEC’s position is consistent with their rhetoric when it

comes to cryptocurrency and blockchain, signalling that there is

likely to be no change in course from the SEC’s

“regulation by enforcement” approach, alleging that

crypto projects should register with the SEC and comply with

existing laws, while ignoring the many lawyers, and Commissioner

Hester Peirce, who have pointed out there is no actual way for

crypto projects to register or comply:

For all of crypto’s promises, the lack of registration and

compliance have very real consequences for real people. As the hard

work of our team shows, we will continue to use the tools at our

disposal to protect the investing public, but it is high time for

the crypto markets to come into compliance

The jury deliberated for a mere two hours after the closing

arguments were heard from the lawyers for the SEC and defendants.

The SEC’s primary argument was that Kwon and Terraform Labs,

under his direction, had deceived investors and consumers about the

nature of the algorithm that pegged its stablecoin, TerraUSD

(TUSD), to the US dollar.

The SEC believes that Do Kwon implied to the public that the

algorithm underpinning the peg operated independently of human

interference. This was a topic hotly debated by crypto enthusiasts

and industry experts alike, with many believing the collapse of

Terra/Luna and TUSD was

attributable to a

“

complex phenomenon that happened across multiple chains and

assets“, rather than concentrated market

manipulation by a third party. As evidenced by the jury’s

decision, the claim that the algorithm was immune from market

manipulation (i.e. human interference) was accepted as fraudulent

behaviour by Do Kwon and Terraform Labs.

As

reported by CoinDesk, a representative for Terraform Labs

stated that they were continuing to consider their options (such as

an appeal) and otherwise remained steadfast that the SEC does not

have authority to bring the case against them.

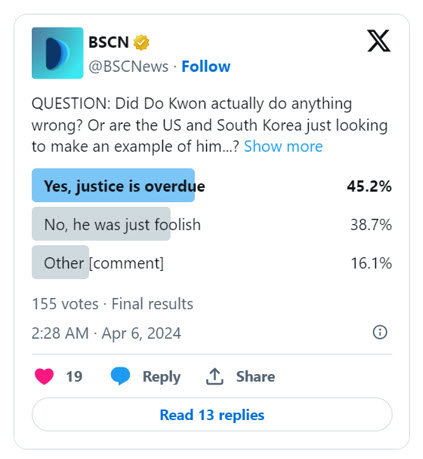

Shrouded in controversy since Terra/Luna’s collapse in May

2022, debate still looms online amongst enthusiasts as to whether

the actions of Do Kwon were wrong, or whether these actions by the

US and South Korea are simply first hand examples of two

jurisdictions wanting to send a message.

Despite a verdict being reached in New York, the battle between

the US and South Korea for Do Kwon’s extradition remains, with

the

Montenegro Supreme Court assessing the conflicting

requests.

In the wake of the Manhattan federal court’s verdict, Do

Kwon and Terraform Labs face the consequences of deceiving

investors about TerraUSD’s stability. As sentencing looms, the

debate over jurisdiction and accountability continues, casting a

shadow over the future of cryptocurrency regulation.

ERC-3643: Compliance by design

The ERC-3643 is a token

standard for real-world asset tokenization, with an

‘open-source suite of smart contracts’ which facilitate the

‘issuance, management and transfer of permissioned tokens’.

The standard is an extension of the ERC-20 standard (a

well-established standard for fungible tokens), with a distinct

compliance layer through a conditional transfer function. This

ensures that token transfers are only executed after approval from

a validator which verifies compliance with pre-defined governance

criteria.

Screenshot from https://tokeny.com/erc3643/

Tokeny, a leading compliance infrastructure provider for asset

tokenisation, first developed the standard in 2018 under the name

T-REX (Token for Regulated Exchanges). Upon acceptance by the

Ethereum Community last December, the standard was given the

current label, ERC-3643. The standard is now backed the ERC3643 Association tasked

with driving its adoption through education and

coordinating key stakeholders. To date, the total value of assets

tokenized using the standard exceeds USD$28B.

Luc Falempin, the co-founder of Tokeny explained in a blog

post:

By creating ERC-3643 with the Ethereum technology stacks, we

ensure the interoperability…with other applications in the

ecosystem.

Tokeny has identified the

key benefits of the standard as:

- Encoded compliance (where rules are embedded within the token

at the smart contract level); - Issuers with greater control over securities;

- Reduced costs;

- Increased transferability and liquidity.

The official

whitepaper, dated May 2023, explains the standard was:

Designed to address this need to support compliant issuance and

management of permissioned tokens, that are suitable for tokenized

securities, either on a peer-to-peer basis or through regulated

trading platforms.

ERC-3643 tokens can readily tokenise traditional financial

assets today, as their permissioned qualities enable compliance

with existing AML and registry requirements. The tokens are also

compatible with most existing ERC-20 standard based platforms and

can be integrated with minor modifications. The ERC-3643 can be

adapted for real-world assets, securities, stablecoins, E-money and

loyalty programs, however, new applications continue to be

explored.

On 9 April 2024, Tokeny announced its partnership with the SILC

Group to pilot alternative assets through

tokenisation using the ERC-3643 standard. The pilot

project will assess the potential of blockchain to ultimately

replace the various legacy centralized systems that are used to

administer funds used by SILC.

Efforts to drive adoption of ERC-3643 are ongoing, with

DevPro and Tokeny jointly releasing an open-source UI component for

the standard in January 2024. This plug-in bridges ERC-20

compatible DeFi applications with permissioned tokens issued under

the ERC-3643 standard, ensuring interoperability.

With the ERC-3643 bringing ‘compliance into the realm of

permissionless DeFi’, the standard offers a pathway for

traditional financial assets to trade on public blockchains. This

is likely to foster

increasing institutional interest in adopting blockchain

technology to unlock the efficiencies of smart contracts in trading

and asset administration, and with a view to increasing

tokenisation of financial markets.

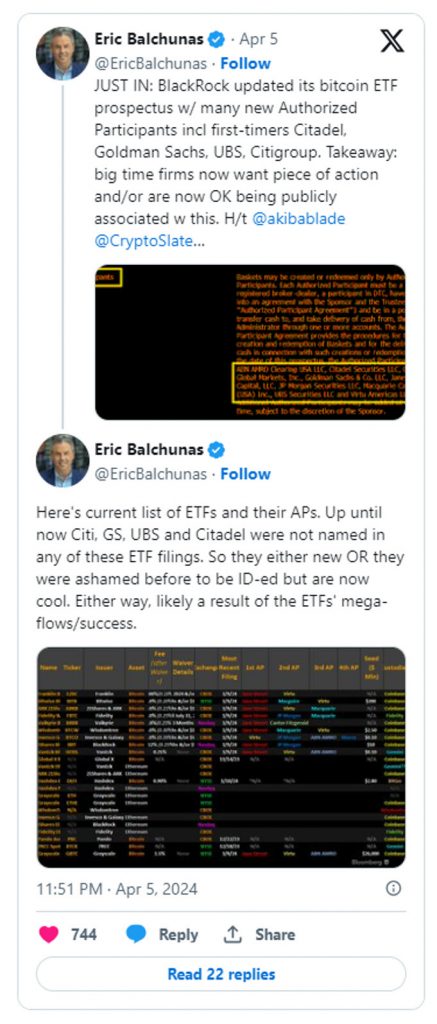

Wall St titans back ETFs, as Bitcoin goes

mainstream

BlackRock’s iShares Bitcoin Trust (IBIT) has seen a surge in

interest from major US banks, marking a significant shift in Wall

Street’s historically sceptical stance on cryptocurrency. In

a

recent SEC filing, BlackRock disclosed that Citadel, Goldman

Sachs, UBS, and Citigroup have been named as “authorized

participants” for IBIT. Authorised participants play a crucial

role in maintaining the correlation between IBIT’s price and

that of bitcoin by creating and redeeming shares in the ETF as

necessary.

While the addition of these traditional finance or

“tradfi” titans underscores the growing institutional

acceptance of cryptocurrency, it also raises eyebrows given their

historical reservations. Goldman Sachs, for instance, has long been

critical of crypto, with its executives dismissing it as an

investment asset class. Sharmin Mossavar-Rahmani, CIO of the

bank’s wealth management unit,

recently reiterated this sentiment, stating that neither she

nor the bank’s clients are believers in crypto.

However, despite such reservations, Goldman Sachs has

established

a dedicated digital assets unit, signalling a pragmatic

approach to the evolving market dynamics. The bank’s move to

support BlackRock’s bitcoin ETF comes

amidst a broader trend of institutional engagement with digital

assets (see recent efforts from

MasterCard and

Citi).

The allure of bitcoin ETFs has proven irresistible to investors,

with reportedly

over USD $12 billion in net inflows recorded since their launch in

January. BlackRock’s ETF alone boasts assets exceeding USD

$16 billion, underscoring the continuing mainstream appeal of

cryptocurrencies.

The inclusion of major US banks as partners in BlackRock’s

bitcoin ETF signifies an important moment in the mainstreaming of

cryptocurrency and bitcoin’s growing legitimacy as an asset

class. The newly announced Authorized Participants join a number of

leading US money managers who have launched their owned Bitcoin

ETFs. As the blockchain ecosystem matures, traditional financial

institutions are recalibrating their strategies to embrace the

emerging digital frontier.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

#Blockchain #Bites #ASIC #appeals #Finder #decision #Australia #scores #early #success #war #scams #DOh #Kwon #loses #SEC #battle #ERC3643 #Compliance #Design #Wall #Titans #bitcoin #ETFs #Fin #Tech