The pandemic has altered consumer behavior, leading to a rise in

the use of smartphones and other technological gadgets. Industry

leaders are focusing on the Indian market because of its huge

volume and growth potential in the online gaming

industry.1

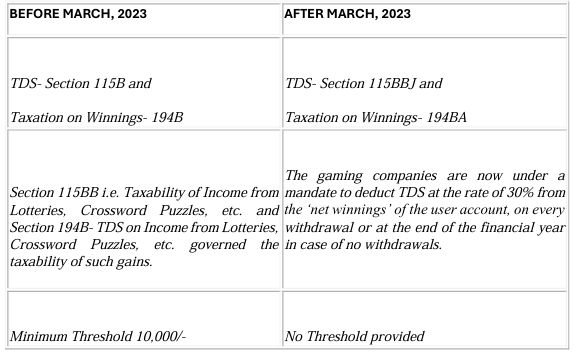

As per the latest norms introduced by Income-Tax Department,

online gaming companies are required to deduct TDS on every rupee

earned from winning an online game by a participant. This rule

kicked in from April 1, 2023 and is applicable since then. Before

2023, TDS on winnings from online games was applicable only if the

winning amount exceeded Rs. 10,000 in a financial year.2

The change in the Indian online gaming industry have raised

concerns about player motivation and reduced earnings. Gamers are

still taking their time to get habitual with the changes.

Purpose behind the Insertion of New Regulation:

The government made the decision to segregate the taxability of

tax gains from online games due to the unique nature of these

platforms. The online gaming industry in India has witnessed a

sudden escalation in popularity and has now become a growing sector

with ample opportunities. In India, many individuals engage in game

activities such as card games, rummy games, fantasy leagues and

online challenges, involving real money transactions.

Below mentioned are the key differences between the previous and

newly introduced provision-

Present- day TDS Deduction for Net Winnings:

The union government carves out a clear description about online

skill-based games. Now, the TDS will be deducted as per the new

introduced Section 194BA of the Income Tax Act, 1961. The TDS rate

on winnings from online games is 30% under Section 194BA.

As per the new norm,

“Net Winnings” is A – (B +

C)3

Where, A= the entire sum taken out of the user’s account

B is the total of the account owner’s non- taxable deposits

made in the user account up to the withdrawal date of the financial

year, and

C is the user account’s opening balance at the beginning of

the financial year.

To put it another way, net profits are determined by deducting

the total amount of withdrawals from the user account from the

total amount of fresh deposits and the opening balance.

As per the new mandate, calculation of TDS will be done at the

conclusion of the financial year or at the time of withdrawal by a

player. The gaming companies are now under a mandate to deduct TDS

at the rate of 30% from the ‘net winnings’ of the user

account, on every withdrawal or at the end of the financial year in

case of no withdrawals.

Penalties for TDS Non- Compliance:

A person is subject to fines and imprisonment for a minimum of

three months and a maximum of seven years under Section 194B if

individuals fail to make TDS payments.

Relaxation on TDS- Exemption:

The Central Board of Direct Taxes (CBDT) has made it clear that

if net gains are less than Rs. 100 in a given month, TDS would not

be charged. But if a player withdraw more than Rs. 100 in a given

month or the month after, this tax will be withheld. The deduction

will take place at the end of the financial year if there isn’t

any withdrawal.4

Bonus, Referral Bonus & other Incentives-

In some scenarios, Online Gaming Companies (OGIs) also provide

bonuses, referral bonuses and other incentives to the players. User

doesn’t deposit any of it in his account but as bonuses and

other incentives spikes the balance in the user account, they are

considered as part of the taxable deposits. Therefore, such offers

will also be considered as part of the net winnings and will be

applicable for TDS deduction.

Net Winning will be determined using the monetary equivalent if

the incentive is in the form of coins, coupons, vouchers, etc. Net

Winnings will not be computed for deposits made with incentives or

bonuses that are credited to the user account solely for the

purpose of playing and cannot be withdrawn or utilized for other

purposes. These incentives do not belong in the opening or closing

balance and are not considered non- taxable deposits. It is

necessary for the companies to keep track of these incentives given

to the user. In the event that these incentives are deemed

withdrawable, their value will be taken into account when computing

net winnings for that particular year.

What happens if the net gains are not paid out of

cash?

At times, an online gamer may receive an item such as car,

motorcycle, smartphone or gadget instead of cash as a prize. TDS

will also be applied to such gains. The fair market value of the

gift will be the basis for determining the TDS.

Conclusion:

In India, online gaming has become popular enough that more

individuals are participating in it for financial gain from the

comfort of their homes. In the upcoming years, exponential

expansion in this industry is anticipated, opening up new job

opportunities and career paths. It is therefore imperative that a

sector with such high earning potential be included in the IT

Act’s purview and subject to separate taxation. In order to

avoid needless legal action in the future regarding the taxes of

online gaming, CBDT may offer more clarity in relation to

rules.

Aishwarya, Assessment Intern at S.S. Rana & Co. has assigned

in the research of this Article.

Footnotes

1 Available at https://www.businesstoday.in/union-budget/opinion/story/online-gamers-to

watch-out-for-new-tds-income-tax-provisions-on-winnings-368828-2023-02-03

2 Available at https://economictimes.indiatimes.com/wealth/tax/tds-on-online-games

winnings-how-companies-will-deduct-tax-as-per-cbdt

guidelines/articleshow/100500282.cms?from=mdr

3 Available at https://www.businesstoday.in/union-budget/opinion/story/online-gamers-to

watch-out-for-new-tds-income-tax-provisions-on-winnings-368828-2023-02-03

4 Available at https://economictimes.indiatimes.com/wealth/tax/tds-on-online-games-winnings-how-companies-will-deduct-tax-as-per-cbdt-guidelines/articleshow/100500282.cms?from=mdr

Related Posts

Cabinet sanctions Amendments for introducing 28% GST on online

gaming

For further information please contact at S.S Rana &

Co. email: info@ssrana.in or

call at (+91- 11 4012 3000). Our website can be accessed at

www.ssrana.in

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

#Mechanism #Calculating #Net #Winnings #Online #Gaming #Income #Tax #Sales #Taxes #VAT #GST