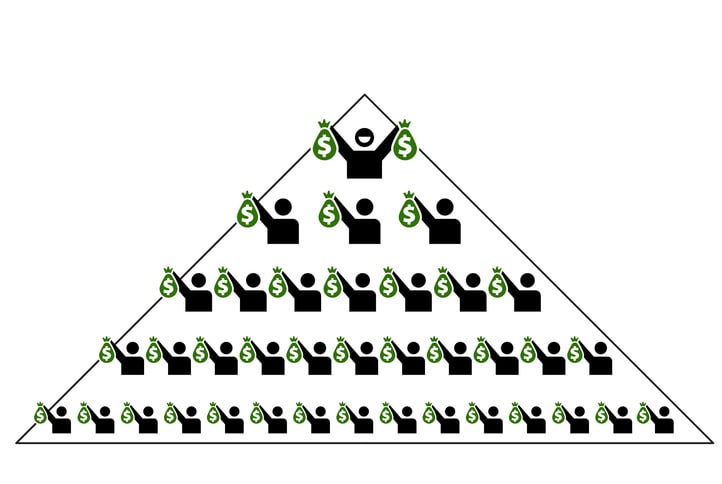

The other day, we chronicled the fate of a former Locke Lord partner heading to prison in the UK for running a Ponzi scheme. Today’s Locke Lord story is about a different Ponzi scheme they got mixed up in. This time, in the United States and the firm was accused of allowing its former client try to pull off the fraud. The firm will pay $12.5 million to settle up in the case of a roughly $122 million fraud perpetrated by a former energy client. For its part, the firm says it did nothing wrong.

The other day, we chronicled the fate of a former Locke Lord partner heading to prison in the UK for running a Ponzi scheme. Today’s Locke Lord story is about a different Ponzi scheme they got mixed up in. This time, in the United States and the firm was accused of allowing its former client try to pull off the fraud. The firm will pay $12.5 million to settle up in the case of a roughly $122 million fraud perpetrated by a former energy client. For its part, the firm says it did nothing wrong.

Heartland Group Ventures and its affiliates took in investments from hundreds of investors promising to put the funds into new projects when, in fact, they were purchasing a plane, helicopter, a beach resort… basically throwing money everywhere except into the ground. The receiver of the defunct entity alleged that Locke Lord should’ve known what Heartland was up to and, had it acted on that knowledge, could have stanched the bleeding earlier.

Per the Receiver’s motion:

After reviewing these documents and researching the law, RCT concluded that there were potentially viable claims against Locke. Specifically, the Receiver is prepared to assert a claim alleging that Locke and its attorneys, as counsel to certain of the Heartland-Related Receivership Parties in connection with oil-and-gas offerings and the Commission’s investigation, knew or should have known that the Heartland-Related Receivership Parties were violating securities laws, were not in compliance with Commission regulations, and were using investor funds to make improper payments, including interest payments to prior investors with new investor funds, undisclosed payments to insiders, and commissions to unlicensed sales representatives. The Receiver would allege that, despite this purported knowledge, Locke, inter alia, negligently advised the Heartland-Related Receivership Parties to maintain the status quo, failed to properly advise the Heartland-Related Receivership Parties of their disclosure obligations to investors, failed to review offering and other key documents for legal compliance for the protection of investors, and failed to advise the Heartland-Related Receivership Parties to cease raising new funds and avoid incurring additional liabilities to investors. The Receiver contends that if the Heartland-Related Receivership Parties had received that advice, they would have stopped raising new funds and would have avoided various categories of damages, including the loss of money through illegal or improper out-of-pocket payments. All of the Receiver’s proposed claims against Locke are referred to as the “Alleged Claims.”

Locke Lord denies that this even amounted to a Ponzi scheme, much less that they contributed to it in any way, but settled in exchange for a release.

Locke Lord and Troutman Pepper are deep in merger negotiations. And nothing makes for an enjoyable merger chat more than the word “Ponzi” coming up twice in the matter of a week.

Texas law firm to pay $12.5 mln over ex-client’s alleged fraud [Reuters]

Earlier: Former Biglaw Partner Gets 15-Year Jail Sentence For Ponzi Scheme

New Biglaw Firm Alert: Troutman Pepper And Locke Lord In Merger Negotiations

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

#Locke #Lord #Settling #Claims #Facilitated #Ponzi #Scheme.. #Ponzi #Scheme #Partners #Jail #Ponzi #Scheme